Am I Better off With an Auction or a Private Sale?

Selling your coins at auction might bring you the most money, or it might not. Before you go that route, check with Don Ketterling. You may save a lot of time and money through our private sealed-bid sales service.

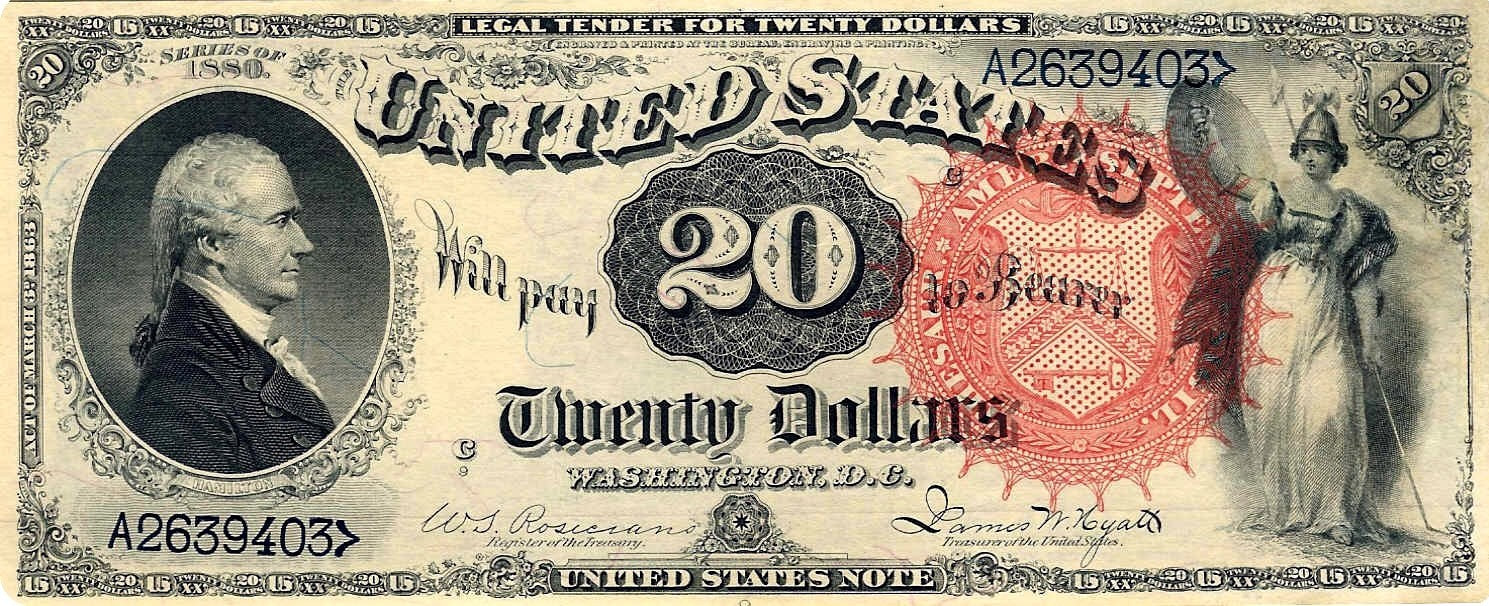

The numismatic marketplace has undergone tremendous change over the decades and in particular over the past 25 years. What many consider a hobby has grown to a multi-billion-dollar industry.

Time and again, records are broken when ultra-rare coins and currency change hands at public auction. The headlines these sales generate bring even more money into the marketplace. Today it is not uncommon to see 30 million dollar sales, and auction houses are expanding rapidly to handle this volume. On the surface, this looks like a booming business and the attention these sales generate attracts more consignors who hope to share the bounty. But there is a downside to all of this excitement.

All auction houses make their money by charging a commission to the buyer that is added to the “hammer” price, thus totaling the published “price realized,” which is the total cost the new owner pays. In many cases, the auction house charges the consignor an additional “sellers fee” depending on the type of consignment and the negotiated terms. 30 years ago, most major auction companies charged a 10% buyer’s fee and anywhere from a 0-5% seller’s fee.

Time and again, records are broken when ultra-rare coins and currency change hands at public auction. The headlines these sales generate bring even more money into the marketplace. Today it is not uncommon to see 30 million dollar sales, and auction houses are expanding rapidly to handle this volume. On the surface, this looks like a booming business and the attention these sales generate attracts more consignors who hope to share the bounty. But there is a downside to all of this excitement.

All auction houses make their money by charging a commission to the buyer that is added to the “hammer” price, thus totaling the published “price realized,” which is the total cost the new owner pays. In many cases, the auction house charges the consignor an additional “sellers fee” depending on the type of consignment and the negotiated terms. 30 years ago, most major auction companies charged a 10% buyer’s fee and anywhere from a 0-5% seller’s fee.

During the last 10-15 years as the success and volume of auction houses has increased, so have their fees. At first, some increased their fees to 15% and much of the industry was shocked. Soon however, nearly all fell in line at 15%. Over the past decade nearly all have gone to 17.5% and seller’s fees can be as high as 10% or more. In 2017, the two largest auction houses have announced a 20% buyer’s fee, much to the astonishment of most professionals.

What does this mean to you, the consignor? Let’s say you are fortunate enough to own a rare coin worth $100,000. 30 years ago, your worst-case scenario would have been that the auction house kept $15,000 for selling your coin and would receive a check (30-45 days after the sale) for $85,000. (They would keep 10% from the buyer and 5% from you as the seller). Today, you might only net $70,000 from a $100,000 coin!

It is important to note that all terms are negotiable and if your consignment is “important enough,” you can negotiate the seller’s fee to zero. But the point to note is that consignor costs have risen dramatically with demand. Add to that, your coins may be tied up for several months before you receive payment!

Another important factor to consider is that the record prices and flashy headlines usually only apply to the highlight coins in a sale. The vast majority of coins trade at the prevailing market levels or less, and you receive 75-85% of that amount. Many people find that the glowing promises offered for a consignment never come to fruition.

The allure of the major auction-houses stems from the hope that they have a buyer on their client list who will bid liberally and aggressively for your coins and currency. The fact is that dealers attend every major auction and are active, aggressive bidders. There is a reason for this ‒ they hope to buy material that they can turn around and sell at a profit, either to other dealers or to their own clients.

The rare coin business originated with collectors. Dealers arose, usually from a collector background, because they could profit by putting sellers and buyers together or by buying a coin that they knew they could sell to an established collector at a profit. Traditional rare coin trading is and remains a personal “one-on-one” business and, in our opinion, is best conducted in that manner. At DH Ketterling Consulting, our private and exclusive sealed-bid sales are a throwback to the classic days of the rare coin and currency business.

Here are the advantages of a DH Ketterling Consulting private sealed-bid sale:

Terms and references are available by request. Our reputation is our success. Call us today to discuss!

What does this mean to you, the consignor? Let’s say you are fortunate enough to own a rare coin worth $100,000. 30 years ago, your worst-case scenario would have been that the auction house kept $15,000 for selling your coin and would receive a check (30-45 days after the sale) for $85,000. (They would keep 10% from the buyer and 5% from you as the seller). Today, you might only net $70,000 from a $100,000 coin!

It is important to note that all terms are negotiable and if your consignment is “important enough,” you can negotiate the seller’s fee to zero. But the point to note is that consignor costs have risen dramatically with demand. Add to that, your coins may be tied up for several months before you receive payment!

Another important factor to consider is that the record prices and flashy headlines usually only apply to the highlight coins in a sale. The vast majority of coins trade at the prevailing market levels or less, and you receive 75-85% of that amount. Many people find that the glowing promises offered for a consignment never come to fruition.

The allure of the major auction-houses stems from the hope that they have a buyer on their client list who will bid liberally and aggressively for your coins and currency. The fact is that dealers attend every major auction and are active, aggressive bidders. There is a reason for this ‒ they hope to buy material that they can turn around and sell at a profit, either to other dealers or to their own clients.

The rare coin business originated with collectors. Dealers arose, usually from a collector background, because they could profit by putting sellers and buyers together or by buying a coin that they knew they could sell to an established collector at a profit. Traditional rare coin trading is and remains a personal “one-on-one” business and, in our opinion, is best conducted in that manner. At DH Ketterling Consulting, our private and exclusive sealed-bid sales are a throwback to the classic days of the rare coin and currency business.

Here are the advantages of a DH Ketterling Consulting private sealed-bid sale:

- Our decades of experience has allowed us to form personal relationships with major dealers and collectors.

- We conduct our sales at EVERY major coin convention and make sure that your coins are exposed to all major and minor dealers, specialists, collectors, grading experts and marketing companies, all of whom know they are competing on a fair and honest playing field and will bid liberally as a result.

- Many of our sales have netted prices in excess of those obtained for the same item in public auctions surveyed over the previous 15 or more years.

- Quick turnaround. Your consignment is needed as little as days ahead of our sales and your proceeds are tendered in the time it takes for checks to clear our bank!

- Our low overhead and high efficiency result in low commission rates and no convoluted contracts with buyer’s fees, “surprise” buyback penalties, etc. In the $100,000 example previously discussed, you would net $95,000 ‒ many thousands more! (Commission fees vary with numbers and types of material.)

- Complete confidentiality and discretion. Your business is between you and DH Ketterling Consulting and no one else!

- Your consignment is completely insured with our policy with Hugh Wood, Inc., underwritten by Lloyd’s of London.

Terms and references are available by request. Our reputation is our success. Call us today to discuss!